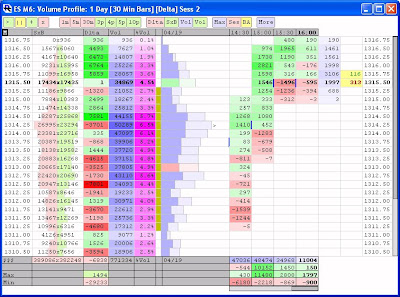

Investor/RT provides Volume Profile charts which break down the buy volume (at ask), sell volume (at bid), total volume, and "delta" of volume (buy - sell volume) at each price, and into various bar periods including minute bars, second bars, range bars, price bars, volume bars, tick bars, and "day" bars. Each bar provides rows at the bottom of the chart which give the cumulative delta, total volume, and max and min delta achieved during that bar. The charts update tick-by-tick and include a replay feature which allows the user to playback the current day, or any previous session, at a variety of speeds. In addition to charting volume, these charts can plot either trades, or time (in seconds) at each price, and divide them up into buy and sell traders (or time). A "Volume Breakdown" indicator is also available that allows the user to access the various volume levels (buy, sell, total, delta) on traditional bar charts of any periodicity. The Volume Breakdown indicator also comes with a "delta bar" option which plots the open, high, low, and closing delta of each bar.

The chart above is an Investor/RT Profile chart setup with the preferences seen below. This particular chart is setup with 30-minute split bars, but a variety of periods are available. This chart is designed to breakdown the volume at each price, and divide it between buy volume and sell volume. Buy volume is defined as volume that occurred at the offer/ask. Sell volume is defined as volume that occurred at the bid. The difference between these two values (Buy volume minus Sell volume) is referred to the "delta" and can be a good indicator of buying or selling pressure. Volume can optionally be broken down by "Big vs Small" trade volumes or "Up vs Down Tick" volumes (as opposed to Buy vs Sell Volumes). However, "Buy vs Sell Vol" is the most common choice and generally regarded as the most informative.

Cumulative Columns

The first 7 columns represent cumulative values for the day (or for the view period specified, if other than "current session"). All columns except the price column are optional. These columns represent the following pieces of data:

- Price

- SxB = Sell Vol x Buy Vol

- Dlta = Delta (Buy Vol - Sell Vol)

- Vol = Total Volume

- %Vol = % of Volume

- Value Area - Volume-based value area (where 70% of volume traded)

- Profile - this histogram profiles the total volume at each price, and breaks it down into buy volume (dark blue) and sell volume (light blue). The red bar represents the open, while the green bar represents the current/last price. The arrow ">" is placed to the right of the POC bar (the bar with the greatest volume).

Split Bars

The right side of the chart breaks down the sessions volume into different bar periods. Several bar periods are available, including:

- Minutes - Time-based bars composed of any number of minutes.

- Seconds - Time-based bars composed of any number of seconds.

- Range - Volatility-based bars composed of any range of price.

- Change - Volatility-based bars composed of any change of price.

- Volume - Activity-based bars composed of any amount of volume. Each bar has equal amount of volume. Trades can be split into multiple bars.

- Trades - Activity-based bars. Similar to volume bars, each bar is composed of a user specified number of trades/ticks.

- Reversals - Volatility-based bars, building upon the concept of Point and Figure.

- Prices - Volatility-based bars composed of any number of prices. Similar to range bars, except the magnitude is expressed in number of prices, instead of actual price range.

- Days - Time-based bars. Day bars are relevant only for multi-day viewing periods, and allow multiple day bars to be seen on a single profile.

- Delta (B - S Vol)

- Sell x Buy Vol

- Total Volume

- % of Volume

- Color Only

- Volume (Delta Color)

- % of Volume (Delta Color)

- Delta Histogram

- Volume Histogram

The extra blue-shaded column on the right of the current bars shows the total volume numbers for the current bar. This column is optional. If the bars are showing volume, then this bar will show delta values instead.

Just left of the price column is a bid/ask column. This column show the bid and ask prices, along with the sizes at each price. Optionally, the user may choose to show the volumes traded at the bid and ask prices since the current bid and ask were established (reset each time bid/ask line changes).

Investor/RT